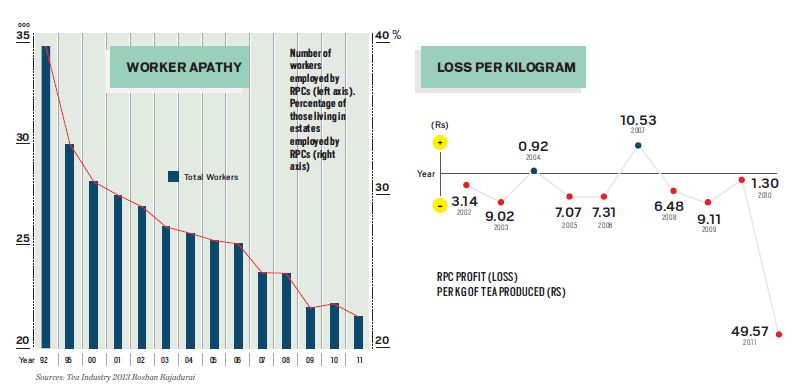

Perceptions are misleading when emotions distort the interpretation of known facts. Tea plantations in the central hills, which still yield some of the island’s signature crops, have been unviable for years. Although the climate, mixing sunshine and a bit of rain in the evenings, is suitable for growing tea, costs are far higher than what consumers are willing to pay. In 2011, the worst year ever financially for growing tea, Regional Plantation Companies (RPCs) lost Rs49.50 for every kilo of tea they produced.

RPCs collectively lost Rs5.8 billion on tea and with other crops thrown in to the mix losses touched Rs9 billion in 2011. Only in two of the ten years ending in 2011 did RPCs together make a profit growing tea. Losses ranged from Rs1.30 to Rs9.10 a kilo until the 2011 catastrophe. Collective RPC performance on tea for 2012 and 2013 were unavailable.

Unless there are food riots or widespread hunger the country’s most significant challenges facing agriculture never intrude upon headlines. Long-term trends – like the financial impracticality of tea in the central hills over the last decade – that can help explain why the crop isn’t attracting investment are rarely considered newsworthy. Industry headlines have instead been limited to its record $1.5 billion dollar export revenue in 2013 and the high auction price for the commodity.

Perspective is key in recognizing the scale of this challenge because the deterioration over a very substantial area accelerated in a decade when tea prices hit record highs and exports also rose to a high of $1.5 billion in 2013.

Sri Lanka’s biggest tea estates are managed by 20 listed and some government-controlled Regional Plantation Companies created in the early 1990s by combining state-owned estates growing tea and rubber. The government-owned estates were not sold but leased for 50 years to the newly created RPCs. When these RPCs were privatized and listed at the Colombo Stock Exchange twenty years ago many of Sri Lanka’s most successful private firms invested in them.

To understand the challenges facing tea and plantation companies that grow it, it’s important to separate these from the RPC’s other crops like rubber and oil palm and also from the small holder-controlled plantations, usually someone’s back yard.

Half of RPC tea bushes are more than 50 years old and generally unviable to pluck. Away from the spotlight high grown tea lands are being abandoned at an accelerating pace. Between 1968 and 2011 land in high grown areas under tea has halved from 81,000 hectares to 41,000 hectares. Under private management of estates from 1992 the abandoning from tea accelerated; naturally because businesses, unlike government managers before them, have to offer decent shareholder returns. Harvestable trees have been grown in some of the land where tea is no longer grown.

RPCs face a stark choice in replanting the low yielding old tea at Rs3.5 million a hectare which then takes 24 years for them to recover the investment, according to a Tea Research Institute (TRI) calculation. “Nobody in their right mind will do it,” says The Planters’ Association of Ceylon’s Secretary General Malin Goonetileke about financial viability of replanting. Diversifying the crop, the usual response to agricultural boom and bust, isn’t an option either in the highlands because estates are mountainous. Only agro forestry (growing harvestable timber) is an option to tea.

There are two worrying features about the downturn in tea. One is the financially crippling impact its decline has on RPCs that have a majority of their leases on tea estates in the central hills. Secondly is the potential impact on the over one million people who live on the RPC-controlled estates and their livelihoods.

There are two worrying features about the downturn in tea. One is the financially crippling impact its decline has on RPCs that have a majority of their leases on tea estates in the central hills. Secondly is the potential impact on the over one million people who live on the RPC-controlled estates and their livelihoods.

Even the government worries that half of low yielding tea land in the highlands may be abandoned soon.

It’s responded by accepting a Planters’ Association proposal for subsidized interest rates and a grace period before capital repayments start on loans to finance replanting. “We have told the government that replanting is a national imperative,” explains Malin Goonetileke. “But we don’t have that type of money.”

It’s unusual for established export industries to receive subsidies in poor countries because these benefit consumers elsewhere in the world. Only fledgling export industries usually enjoy such coddling, to help establish them in international markets. But the tea industry is 150 years old.

Planters’ argue that decline is not the destiny of the tea industry. However, it’s not perceptions that will prevail but the industry’s ability to deal with the cost pressure that has pushed it in to the red and its ability to retain its work force. The issues of cost and retaining a workforce are somewhat interlinked.

The corrosive cocktail was brewing by the time of privatization in 1992. Many plantations were losing money, under state management land had been depleted and worker agitations for higher pay were growing. Tea plantation workers are poor, live in squalid conditions and have lacked social mobility due to low education attainment.

Because it’s labour-intensive and resists automation, tea growing is also costly. Even though the climate is suitable the rising costs will send out of control plantation firms’ ability to regain their competitiveness. Nearly 70% of the costs of tea growing are related to labour. Roshan Rajadurai, the Chairman, Planters’ Association says getting costs under control is the major challenge for the RPCs which the association represents. Rajadurai emphasizes the strategy is not to be a low-cost producer, but one that is quality oriented. “We have a niche product as a producer of unique tea.”

The RPC workforce has shrunk 40% in the last twenty years from 345,000 at the time of privatization to 208,000. Planters’ Association’s Rajadurai, who is also Managing Director at Hayleys-controlled Kelani Valley Plantations PLC and Talawakelle Tea Estates PLC, dismisses the notion that the workforce will shrink another 40% in the next two decades.

If indeed it does shrink by 40% or more, because better economic opportunities attract people out of the plantation sector, estates will face a severe labor crisis challenging their harvesting of existing productive tea bushes, leave alone the crop from the replanting they intend to do.

P Jayaram was a field officer at Maskeliya Plantation’s Talawakelle Estate six years ago, “There were 500 workers in the division when I started but in 10 years it fell to 170. It was a rapid decline.” In the frontlines field officers and estate managers have to entice for low paying plantation work people who now have far more lucrative opportunities. Jayaram predicts there will be chronic labour shortages in five years in even estates that have plenty of labour now. “Those who study beyond 16 years don’t come to the plantation to work at all,” he observes.

“There is no shortage. The labour is on the property, it’s a managerial challenge to get them to come and work,” contends Rajadurai. A million people live on the estates but fewer and fewer of them are willing to work there. At the time of privatization in 1992, 41% those who lived in the estates also worked there. Now only a fifth of the resident population works in the estate. The plantation companies however provide infrastructure supporting the entire resident population so long as one person in a family is employed in the estate for at least one day a month. “They are smart and they game the system,” Rajadurai admits about workers who live in the plantations but work outside.

“There is no shortage. The labour is on the property, it’s a managerial challenge to get them to come and work,” contends Rajadurai. A million people live on the estates but fewer and fewer of them are willing to work there. At the time of privatization in 1992, 41% those who lived in the estates also worked there. Now only a fifth of the resident population works in the estate. The plantation companies however provide infrastructure supporting the entire resident population so long as one person in a family is employed in the estate for at least one day a month. “They are smart and they game the system,” Rajadurai admits about workers who live in the plantations but work outside.

Father Benny, a firebrand Jesuit Priest, has been fighting for plantation worker rights for decades. He laments that the estate worker’s lot hasn’t improved much in 200 years and that they have had to fight for basic rights which everybody else takes for granted. “Stateless, vote-less and now landless,” he traces the progress of the fight for basic rights. Plantation workers were only recognized as citizens in the nineteen eighties and it took many years before they were all registered to vote. He says the next battle is for land.

“One of the delays to this housing issue is that people don’t see it as a big issue,” he explains from his Hatton office at the Center for Social Concern. “They are trained or accustomed to get minimum privileges from the trade unions and the government.” The government has recognized home ownership as a policy priority but not done anything about it yet. “Unless a worker gets a house the progress will be slow. Only when I feel this is my own house will all other aspects like self confidence, stability and courage come. That is the biggest block.”

Tea plantation workers are the most impoverished section of society in Sri Lanka. Including attendance incentives their daily wage is Rs620, earning Rs14,300 for working 23 days a month. Income poverty, defined as the cost of meeting a minimum nutritional requirement (2,030 kilo calories daily) and other basic needs, was 11.4% in the estates in 2010.

Sri Lanka’s poverty line offers a dystopian view of life for a population that has aspirations of a middle income country. A family of four with an income topping Rs13,000 a month is considered not poor. A more relevant poverty measure like income of $2 per person per day, requires a family of four to have a monthly income of at least Rs31,000 to escape the poverty definition. Sri Lanka’s poverty level will climb to 25% from the official 8% if the $2 a day measure were adopted.

As industrialization creeps in to the provinces opening other employment options few will be willing to brave the bitter cold to get to the fields at dawn, the ignominy of relieving themselves behind tea bushes, being burnt by the harsh highland sun and still not making enough money in a day to afford the monthly rental on a cable TV service offering multi-channel, back-to-back Tamil movies and music.

Tea is the second most popular beverage in the world next to water. For people in China, India and many other parts of the world drinking tea is a pleasurable daily ritual. As the populations in these Asian markets and new ones in the Middle East and Eastern Europe discovered the beverage, demand soared. Sri Lanka produced a fifth of world tea demand in 1960 when global production topped a billion kilograms. While the size of the crop kept growing other producers who had lower costs and better conditions caught up and overtook.

By 2012, Sri Lanka’s tea production had roughly doubled from 1990 levels, but its share of the global crop had declined to seven percent from 21% in 1960. China, India, Kenya and other Asian and African countries grabbed most of the new consumers in the now annual 4.7 billion kilograms a year tea market.

Declining competitiveness because of the high production cost should have alarmed the industry enough to reexamine the strategy two decades ago, but its straightjacket thinking and a hang-up with century-old traditions, has made change difficult.

“Now we are in a lunatic mode,” sums up Dan Seevaratnam the predicament of the tea plantations. “Doing the same thing and expecting a different result is lunacy. If it doesn’t crash I will be very surprised,” says the 40-year industry veteran. Seevaratnam is a maverick in an industry that otherwise has its straightjacket on so tight that even a gulp of tea wouldn’t pass through its digestive system. Its crisis response of incremental improvement grossly underestimates the scale of the challenge.

“Now we are in a lunatic mode,” sums up Dan Seevaratnam the predicament of the tea plantations. “Doing the same thing and expecting a different result is lunacy. If it doesn’t crash I will be very surprised,” says the 40-year industry veteran. Seevaratnam is a maverick in an industry that otherwise has its straightjacket on so tight that even a gulp of tea wouldn’t pass through its digestive system. Its crisis response of incremental improvement grossly underestimates the scale of the challenge.

Seevaratnam, who is also Chief Executive of Watawala Plantations PLC, estimates the plantation tea crop will halve to 60 million kilos and the small holder crop will decline to 150 million kilos in the next decade unless there is radical change. “We want the worker to change and the government to change but are we willing to change?” asks the tea executive who expects to be retiring from the industry soon. It’s not hollow bravado. In the last decade Seevaratnam has reengineered the relationship between the plantations and their employees from a wage guarantee to a livelihood guarantee model. Marginal lands were assigned to workers to manage by themselves. The firm then purchased the tea from the contracted out land instead of paying wages for the people working them. “To move forward we need to redefine this job security of a worker. Earlier it used to be a guaranteed number of days. I’m proposing this as an alternative, as a guarantee of a livelihood,” says Seevaratnam. Workers in their spare time also work for the plantation company and get daily wages for that separately.

David Gibben, a British manager at an estate in Watawala, experimented successfully with what he called ‘block plucking’ in the nineteen fifties, based on the same principle of allowing workers to manage small tracts of land and buying their produce instead of paying them wages. However, it didn’t catch on and by then the British also realized that they would soon have to leave and stopped innovating. “I know production, branding, marketing. Workers know cultivation and harvesting. So divide and give the land to them,” Seevaratnam argues.

Good Ceylon tea is best allowed to brew for two minutes and drunk hot. However, since Sri Lankan firms were only focused on producing a commodity and getting it to market, they completely ignored the rest of the supply chain, the branding and the consumer experience. For tea, a Sri Lankan firm could have done what Starbucks has done for coffee. ‘Teavana’, now a Starbucks-owned business, is starting to do for hot and iced-tea what the firm has done for coffee.

Firms unwilling to innovate and take risks get left behind. But few plantations, brokers or exporters have been willing to leave their comfort zones. They see innovation and branding as someone else’s responsibility.

However, buyers pay premiums for Ceylon tea. Auction averages have topped $3 a kilo since 2009. Prices of Kenyan and Indian tea, the other two major tea exporters (most Chinese tea isn’t exported), are $0.5 to $0.7 less on average, than a kilo of Sri Lankan tea.

However, buyers pay premiums for Ceylon tea. Auction averages have topped $3 a kilo since 2009. Prices of Kenyan and Indian tea, the other two major tea exporters (most Chinese tea isn’t exported), are $0.5 to $0.7 less on average, than a kilo of Sri Lankan tea.

But the fortunes of tea are sharply divided so auction averages can be misleading. All over the island the decline of small farms is well documented, but in tea the reverse is true.

RPCs reducing tea acreage in the high grown areas has been offset by small holders in the South of the country adding tea in their backyards. They have almost doubled the hectares under cultivation from 62,000 to 110,000 between 1992 and 2011 in low grown areas. The resulting addition to the crop, pushing up overall output, disguises the underlying profound change; that plantations in the central hills are struggling.

Backyard family tea plantations are hardly a fraught minority. They now produce 70% of the crop and the low grown teas they produce fetch higher prices. A combination of factors like soil, weather, the availability of labour and careful nurturing has resulted in yields that are almost double the levels achieved in the highlands.

A rise in non-farm jobs is less challenging for family-managed plantations which are usually small enough to run without having to hire workers. RPCs lucky to have plantations in the lowlands are also doing better than their highland counterparts because tea yields are much higher and they have diversified in to oil palm, a crop that is three to five times more profitable than tea.

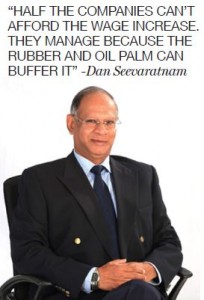

Every two years plantation worker unions negotiate a wage increase on behalf of their 200,000 members. For many highland tea plantations higher wages are no longer affordable. Unions also recognize this but demand an increase to make up for inflation at least. “Half the companies can’t afford the wage increase. They manage because the rubber and oil palm can buffer it,” says Seevaratnam, “but it has now come to a stage they can’t buffer anymore.”

In a decade, Sri Lanka’s per capita GDP will comfortably surpass $10,000 (about the level in Malaysia now) if nominal economic growth continues at the current pace. Its construction and tourism sectors will be booming and with some smart economic policies hundreds of new factories will herald a new industrial age. Few doubt that millions of new jobs will be created and will be quickly filled by the unemployed, the underemployed and ones eking out a difficult living in the plantations. Even low-skilled 200,000 plantation workers will find better contracts outside because the estates can’t afford to pay much higher salaries.

In a decade, Sri Lanka’s per capita GDP will comfortably surpass $10,000 (about the level in Malaysia now) if nominal economic growth continues at the current pace. Its construction and tourism sectors will be booming and with some smart economic policies hundreds of new factories will herald a new industrial age. Few doubt that millions of new jobs will be created and will be quickly filled by the unemployed, the underemployed and ones eking out a difficult living in the plantations. Even low-skilled 200,000 plantation workers will find better contracts outside because the estates can’t afford to pay much higher salaries.

Malaysia today is a good example of the level of wealth that can be expected in Sri Lanka in a decade. There is no possibility of running a tea plantation there because of the economics of the trade. Only oil palm flourishes and rubber in the most rural parts of Malaysia.

International tea prices will of course soar with growing affluence in Asia and the Middle East increasing demand. But this will benefit brands more than plantations and Africa where production costs are the lowest.

To survive the next decade plantation companies will have to resort to automation, first with shears which pluckers use instead of picking tea leaves by hand, and then machines which are already being used in some parts of Southern India. Because of the low social status of being a plantation worker, who as recently as 30 years ago were referred to as ‘coolies’, estates will find people difficult to attract.

As many plantations lack the vision to realize the scale of the challenge they will be ill-prepared and taken by surprise. Tea will continue to be grown in Sri Lanka in a decade but much less of it than now. In twenty years there will be very few plantations. Some senile nostalgic men, perhaps ones who are working as estate managers now, may continue the legacy.